Bough helps a global technology company implement an effective and a cost-effective revenue assurance program to ensure regulatory compliance and meet audit requirements

ERP implementation

Change management and trainings

Data optimization and governance

Process standardization and optimization

Revenue recognition automation

Pre-migration readiness and post-migration balance sheet reconciliations

Background and challenge

A $3 billion global technology company was undergoing a major finance transformation effort, including implementation of an SAP RAR revenue automation tool and data management platforms, to cater to the new demands of ASC 606. As a rapidly growing and continually evolving company, they found themselves left with an incomplete ERP implementation. Complexity of its business, compounded by poor planning, management, and execution and by the previous Big 4 consulting firm, resulted not meeting the go-live deadline substantially risking the company’s investment and strategic goals of recording revenues using RAR to support their growth.

In need of rapid assistance, Bough was engaged to evaluate the current state of the ERP, execute changes where necessary, build and deliver on the SAP RAR implementation mandate, and guide the accounting operations team to future deadline success.

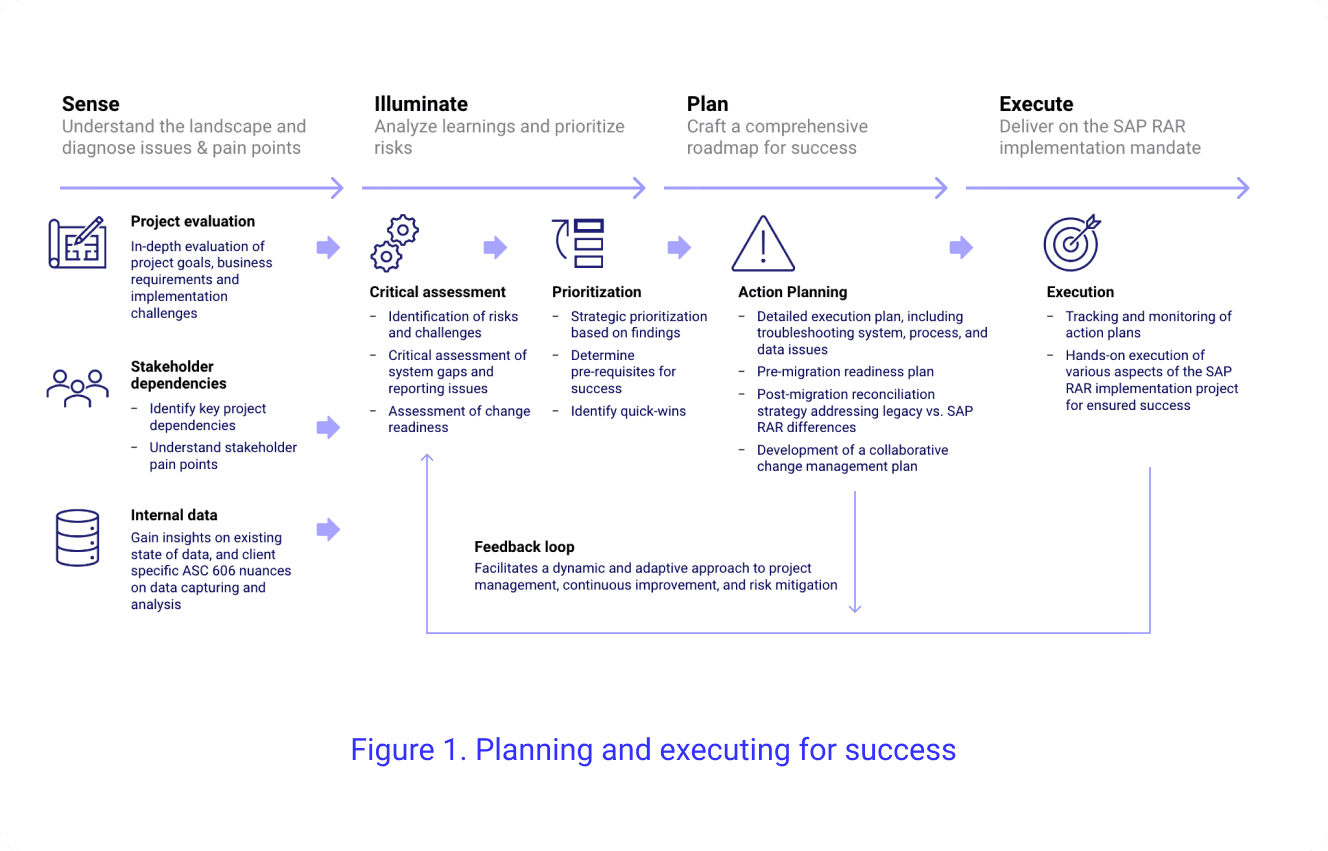

Approach

Our approach was founded on the principles of strategic alignment, prioritization, and collaboration – designed to deliver immediate value and set the stage for long term success

Need for better data governance

At the very onset Bough realized, to ensure the success of transformation efforts, there was a need to review, standardize, enhance, and automate some of the existing mission critical F&A processes. Given, the more detailed and comprehensive disclosures of ASC 606, created new demands on data capturing and analysis processes. For instance, the introduction of performance obligations and contract balance movements reports meant that a new level of data had to be identified, compiled, integrated, or stored.

To meet this sub-mandate, we extended the support in streamlining data entry and reporting across the business units – incorporating best practices and partnering with client stakeholders and other implementation vendors on the project. Our focus was to narrow down on all additional data that will be required and work with business IT to identify the data sources, provide the transformational logics, design the reporting capabilities and the IT infrastructure to meet the brief.

ERP evaluation and execution

With an ERP implementation left incomplete and an accounting department heavily understaffed, our team immediately stepped into the role to much provide the much-needed expertise to see the initiative to the finish line. We evaluated the critical business requirements, the current state and pain points, reporting gaps, change readiness, and communication plans. Gathering data and information where appropriate and making necessary changes to the system set-up while continuously trouble shooting system issues to deliver a functioning and correctly modified ERP

Pre-migration readiness

This was the most critical phase of the project with project success heavily reliant on ensuring minimum data quality and performance of all pre-migration controls. Prior to our arrival, historical data validation and optimization were never successfully completed. We led a full reload of five years of historical data and completed the validation, cleansing and optimization of all key revenue data – including evaluation of legacy contract combinations, material and product master data, customer master data, project data and transactional revenue data. The pre migration controls revolved around completeness and accuracy of all this data flowing into RAR and making sure all known issues were appropriately flagged and addressed prior to cutover and there are no unknown surprises.

As part of pre-migration readiness, we were also involved in reviewing the design of the SAP Project System (PS) modules. This entailed ensuring all projects migrating to RAR had standard project structures developed, project costs are appropriately reflecting, and WBS details are accurate and complete, and the calculated project percentage of completion is reasonable and consistently flowing into RAR for computation of professional services revenues.

Post-migration balance sheet reconciliations

Given the differences on how the legacy revenue reporting tool and the new SAP RAR tool operated, we had expected differences between Legacy system positions vs New system (RAR) positions. We knew this would be no mean feat, and given our past experiences with system implementations, this is one of the most complex and time intensive exercise. Hence we deployed our A-team of 5-10 resources tackling individual business scenarios and working relentless to identify the root cause and reconcile the differences.

Our team performed a deep-dive comparison of legacy GL balances with RAR balances and also were accountable to post the correction entries to ensure the opening balance to be loaded to new system was correct. Depending on the root cause and business scenario identified, we devised a mapping matrix logic, to map revenue arrangements to appropriate solution codes with their unique and appropriate accounting treatments; to ensure that future revenues/postings reflect correctly.

Identifying the customer

We identified significant weaknesses in how the company went about their contract combinations and modifications. Given, ‘Identifying the customer’ is the first step of the 5-step ASC 606 rev. rec. model, if we didn’t get this right, then all downstream impacted processes and eventual rev. rec. would also be incorrect. Our team deployed a dedicated data governance team and invested a significant amount of time to audit the upfront quoting and opportunity creation process and the contract combination rules and logics deployed in the front-end deals configurator system. We worked closely with sales and enterprise architecture teams to correct the logic issues, bridge the process gaps, and provide extensive training on combination rules and data entry to the sales and delivery team who enter the data.

Given how contract combinations impact the timing and amount of revenues being recognized, the auditors were keenly interested to see what we have in place as a company to ensure comfort. To meet this request, we designed and implemented an automated review process that addresses the risk or under and over grouping of contracts to meet audit requirements. With this the company had a good sense of its contracts, deals, and nature of modification on them, if any and depending on the underlying business rules whether it merited a retrospective or a prospective accounting treatment

Ready for the future

In preparation for the post go-live world of the ERP implementation Bough provided extensive change management support and trainings including, training coordination, custom training materials, cut-over plan, and mitigation plan. Change management toolkits were designed to identify key stakeholders and conduct change impact analysis. All these factors ensured for a smooth transition, timely team communication and involvement of key and impacted stakeholders.

Results

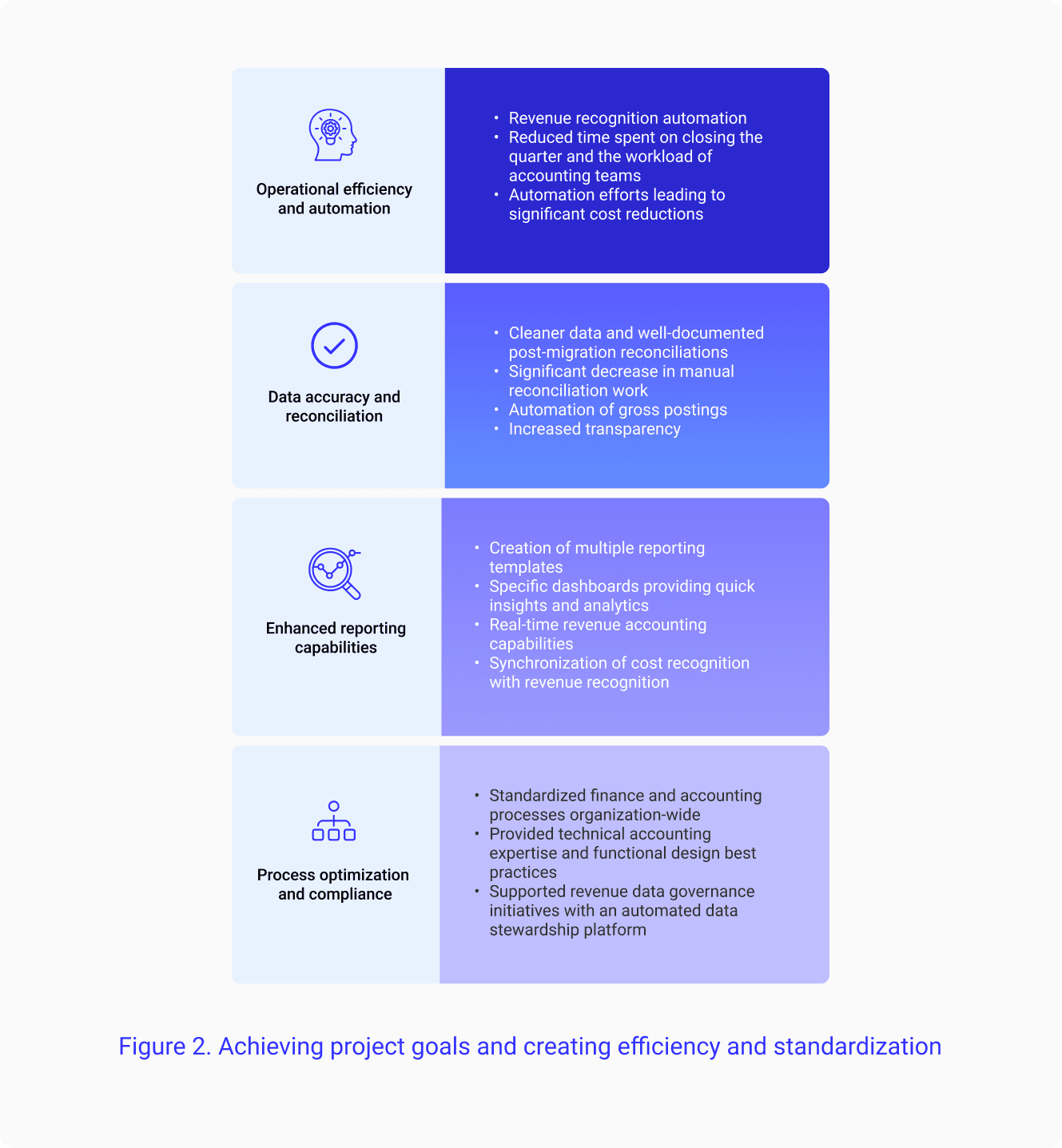

Bough proficiently saw the project through to a very successful go-live of SAP RAR. The implementation of this new revenue recognition automation tool laid the foundations, both procedurally and technically, for future increases in efficiency in finance and accounting.

Reduced the time spent on closing the quarter and reduce workload of the accounting teams

Cleaner data and well documented post migration reconciliations significantly reduced manual reconciliation work and has now largely automated gross postings and increased transparency in the finance department. To aid our reviews we created multiple reporting templates from the system to adhere to reporting demands and requirements. Our team also successfully created months of backlogged reports to get the accounting department up to date on reporting requirements.

Compared to the legacy revenue recognition engine, SAP RAR provided real time revenue accounting capabilities, synchronization of cost recognition with revenue recognition, and the availability of various new, compulsory disclosures (e.g., reports showing the disaggregation of revenues by different categories, contract balance movements and upcoming revenues expected for outstanding POBs) etc.; helping the company realize the true benefits of RAR

Transparent cost tracking for all project phases (from offer to order processing to completion phase) thanks to standard project structures

Bough’s combination technical accounting, process improvement, and system implementation expertise shortened the month-end close by several days and reduced the number of resources involved in the deferred revenue calculation and recognition and monthly reporting processes

With Bough assistance, the Company was able to standardize finance & accounting processes throughout the organization. Our team provided technical accounting expertise and functional design best practices to streamline future state policies, procedures, and controls. We built tools to enhance training across all business units with detailed desktop manuals to be utilized by the Company in the future to maintain industry leading practices.