Bough helps a global technology company implement an effective and a cost-effective revenue assurance program to ensure regulatory compliance and meet audit requirements

Revenue Assurance

Accounting process optimization

Financial audit readiness and support

Process and controls implementation

Accounting policies and procedures

Technical accounting staff augmentation Technical accounting staff augmentation

Background and challenge

The client was confronted by the continuous challenge of keeping pace with the increasing complexity of financial reporting and disclosure requirements. In addition, prevalent stringent regulatory environment had put the organization’s accounting practices under the spotlight with greater amount of scrutiny by the stakeholders

Disparate accounting practices followed within the company across various geographies, coupled with the intricacies of their business environment and transactions accentuated the issue and made it tougher for the company to manage their accounting and finance processes and often found themselves hard pressed to meet the additional regulatory requirements

The client engaged Bough as their accounting advisors to work alongside their internal teams and provide the depth of knowledge and experience necessary to address these eclectic accounting issues faced by the company.

Solution - Strategic intervention by Bough to navigate complexity with expertise

Bough leveraged their subject matter expertise and assessed the client’s accounting and finance processes and controls, primarily focusing on the timeliness and accuracy of the financial and management reporting

Reviewed client’s business transactions across various geographies including North America, Latin America, Europe, Middle East and Africa and the Asia-Pacific regions

Applied our in-depth understanding of the client’s business and nature of revenue arrangements to:

identify underlying risks

assess adequacy of existing controls and procedures around revenue recognition; and

highlight areas of concern due to inefficient/loosely implemented processes and controls

Worked closely with the management and external audit team to:

validate components of financial data

perform cut-off procedures

execute key SOX controls involving revenue recognition related to software license provisioning and resolve issues

review auditor’s exceptions listing from revenue testing procedures performed in prior periods to devise remediation plans

proposed process & control enhancements to prevent future issues

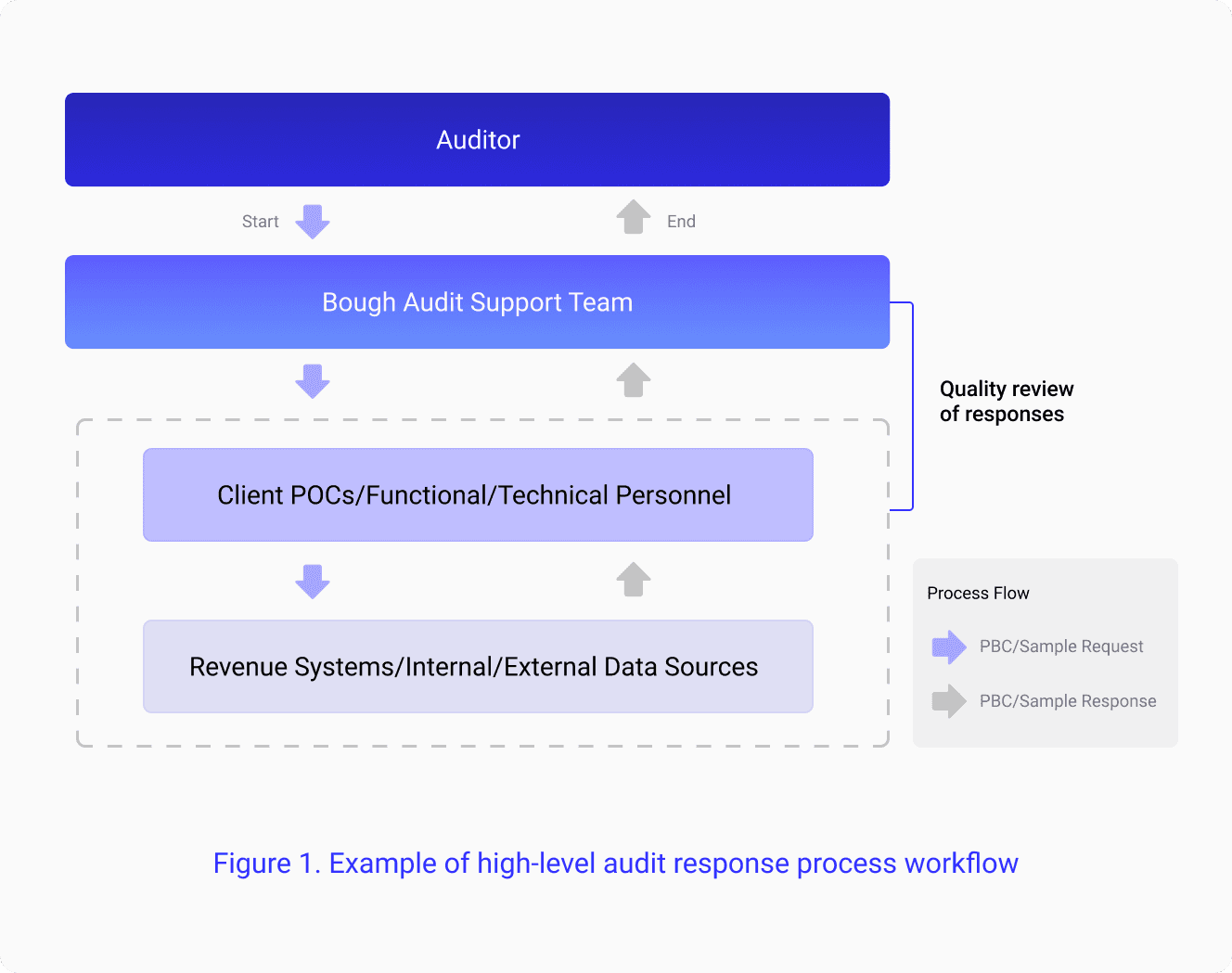

Acted as a liaison between the Company and the audit team to ensure that the audit is completed timely and efficiently

Prepared technical accounting calculations, policies, and memos, as required

Reconciled balance sheets, as appropriate for each audit period

Deployed a full-time augmented staff that played role within the company’s operational accounting function and proactively planned/executed necessary daily, weekly, monthly, and quarterly accounting activities as required

Results - Enhancing audit effectiveness and quality

With Bough’s assistance, the client was able to address and resolve the critical accounting issues and make informed business decisions on their financial reporting procedures

As there is a need to be answerable to the stakeholders, management relied on Bough as trusted advisors to equip them with relevant information around the current accounting practices within the organization and implications of the various accounting issues on their business

Established detailed technical accounting memos, policies and thought leadership material pertaining to key processes and controls around revenue reporting and documented accounting procedures to retain critical knowledge and train new employees. These efforts resulted in streamlining the accounting practices within the company and enabled accurate and timely financial reporting for the client

Enhanced cost-effectiveness achieved by reducing effort in transaction testing through process automation and technology utilization, resulting in improved efficiency

Synergy exhibited by the Bough team working out of the US and the India offices throughout the project, provided the client with a virtual 24-hour workday facilitating a quicker turnaround of the deliverables and expedited engagement delivery