Bough helps a global technology company implement an effective and a cost-effective revenue assurance program to ensure regulatory compliance and meet audit requirements

Conceptualize and implement the end-to-end revenue accounting solution

Target operating model design

Design new processes and institute controls

Change management

Trouble on all fronts

Our client is a global technology company with revenues of over $3 billion and is a leading provider of contact center, unified communications and networking products and services. They were required to adopt the new revenue recognition standard (ASC 606) and as a result, needed to transform its accounting and financial reporting process to meet the new requirements. With uncertainty around implementation of their initial plan, Bough was called upon, one month before the ‘go-live’ date of the initial solution, to implement an alternate solution to meet the ASC 606 compliance mandate timely.

Partnering for success

In view of the client’s existing data and time limitations, Bough was entrusted in delivering the following:

Conceptualize the end-to-end revenue accounting solution

Complete build, UAT and deployment for the accounting solution

Design and finalize new processes and controls

Project management support

Manage change, conduct trainings, and build organizational awareness

Operationalize and manage the new process

Achieve audit readiness

Bough offered the technical expertise, guidance, and systematic breakdown of expectations / requirements to enable IT to effectively use their knowledge of enterprise systems, technology, processes, and data to achieve the end goal.

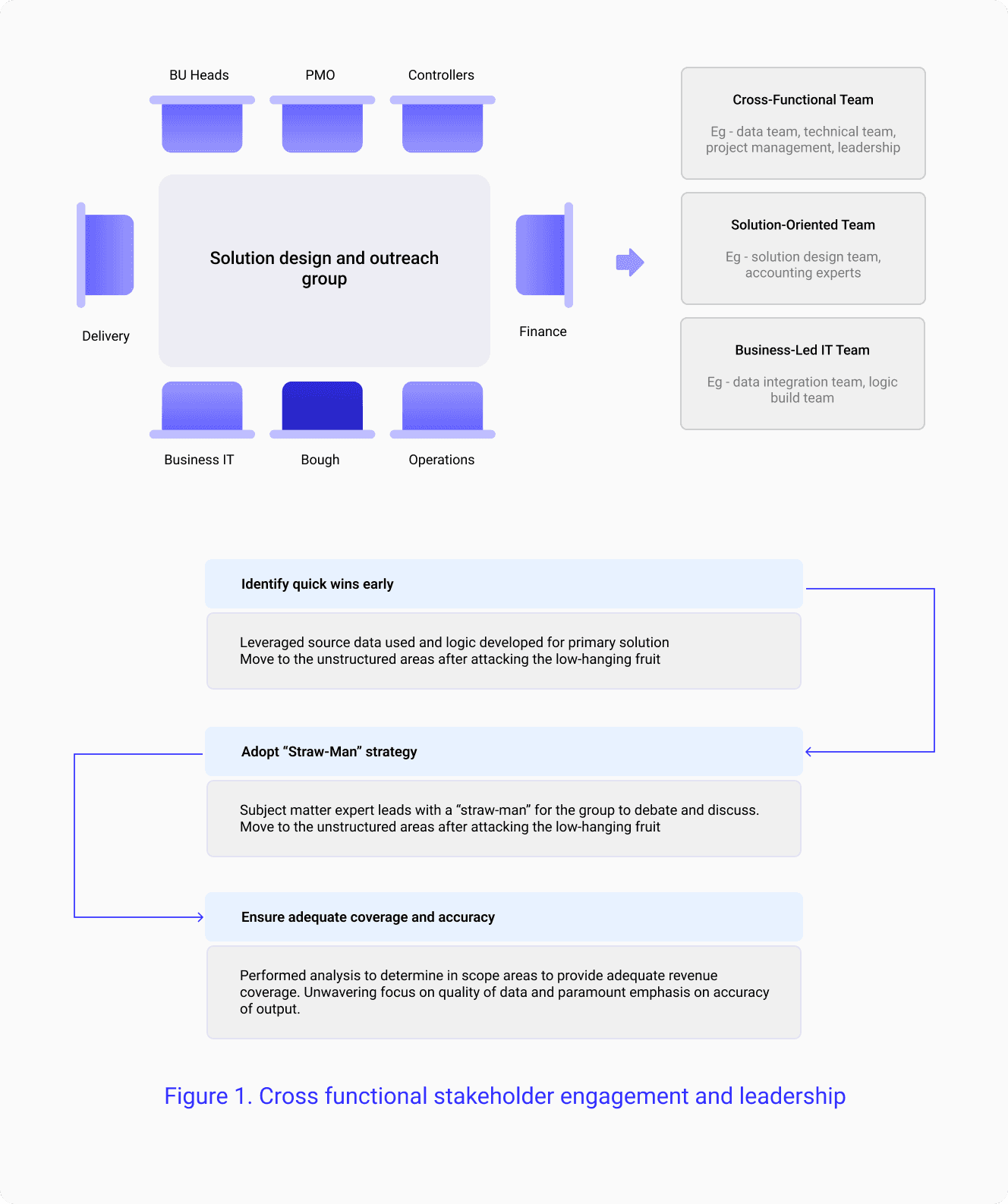

Capitalizing on existing and newly developed synergies

Bough owned the overall process and engaged with stakeholders to identify pain points and opportunities. We worked closely with business IT to deliver the technology functionality and provide integration capabilities that included: developing a data warehouse; integrating critical systems; and creating a single source of truth.

Bough's project leadership included engaging cross-functional stakeholders to understand their needs, identifying quick wins, and implementing a 'strawman' strategy for precise execution of the new accounting solution.

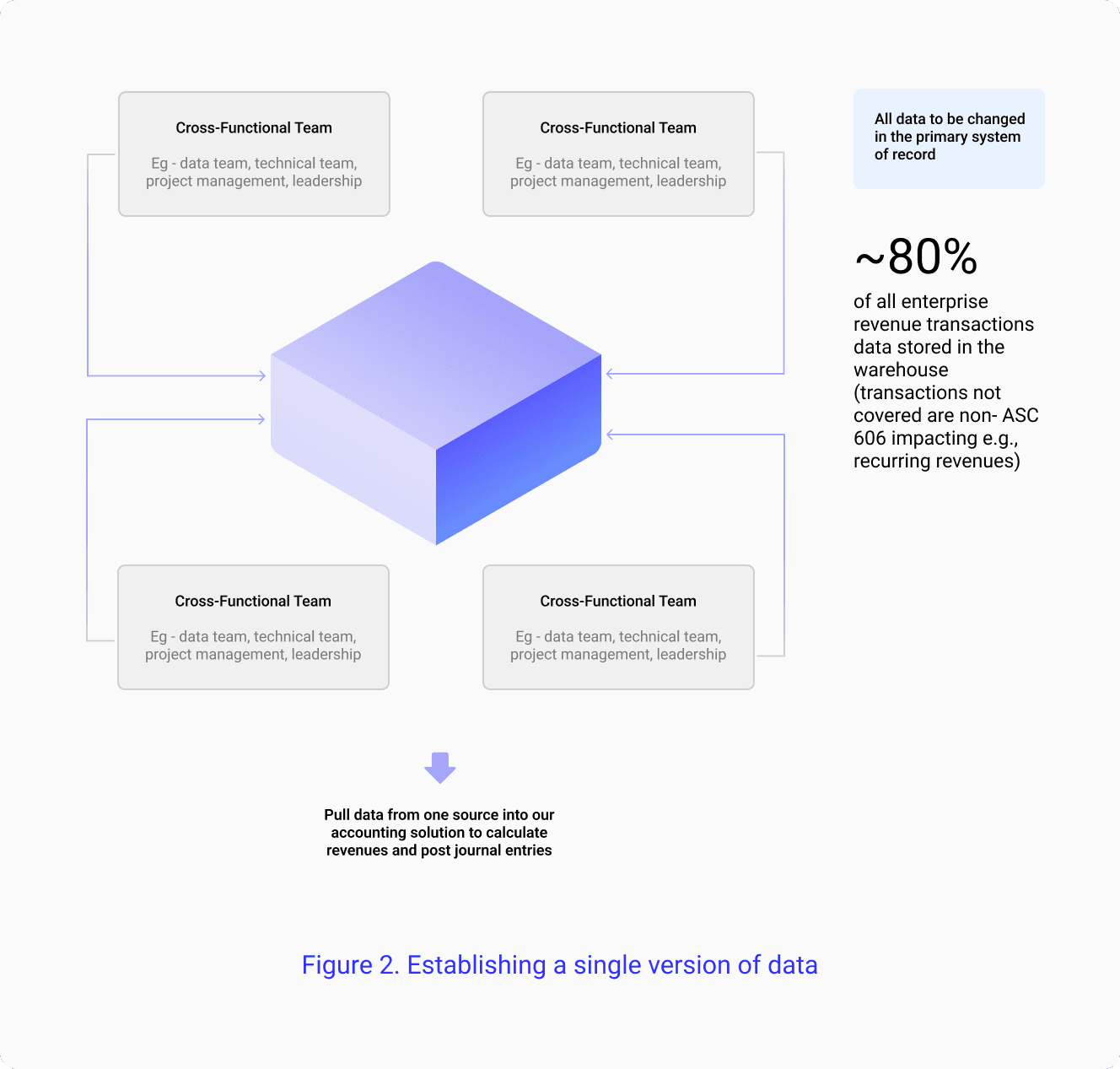

Ensuring all key data in one place, i.e., the data warehouse that stored ~80% of all enterprise revenue transactions (transactions not covered were the non- ASC 606 impacting e.g., recurring revenues), enabled us to pull in the requisite information efficiently into our accounting solution to calculate revenues and post journal entries

Establishing a single version of data

Results

With Bough’s assistance, the client was able to establish an ASC 606 revenue recognition model to meet its accounting and financial reporting needs.

Value Delivered

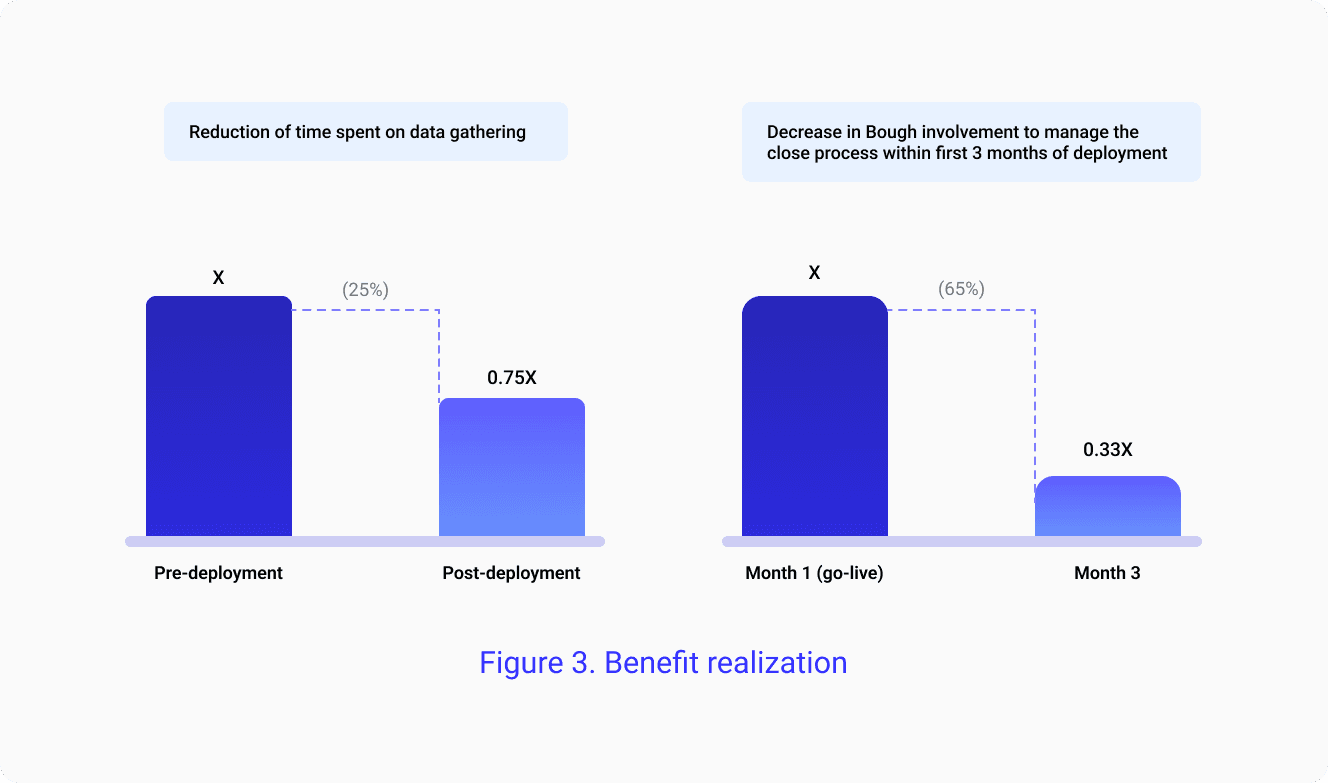

Effectively built the solution, enabling Bough to transform the ASC 606 book close process within 3 months of deployment: effectively meeting SEC reporting requirements

Delivered capabilities for ‘Data and Information Management’ to support journal entries, project reviews, reporting, financial analysis etc.

Designed internal controls and finalized revenue recognition review checklists

Operationalized the process successfully, reducing Bough involvement in managing the reviews from 12 to 4 resources

Achieved audit readiness of the new process, managed audit requests and achieved SOX compliance

Reduction of time spent on data gathering by 25%

Conducted trainings to increase awareness levels of the organization on ASC 606 book close and the new revenue accounting & reporting solution