Bough helps a global technology company implement an effective and a cost-effective revenue assurance program to ensure regulatory compliance and meet audit requirements

Interim Controllership support

Technology integration

Process automation

Skill enhancement

Data validation

Financial reporting

Compliance improvement

Overcoming acquisition challenges

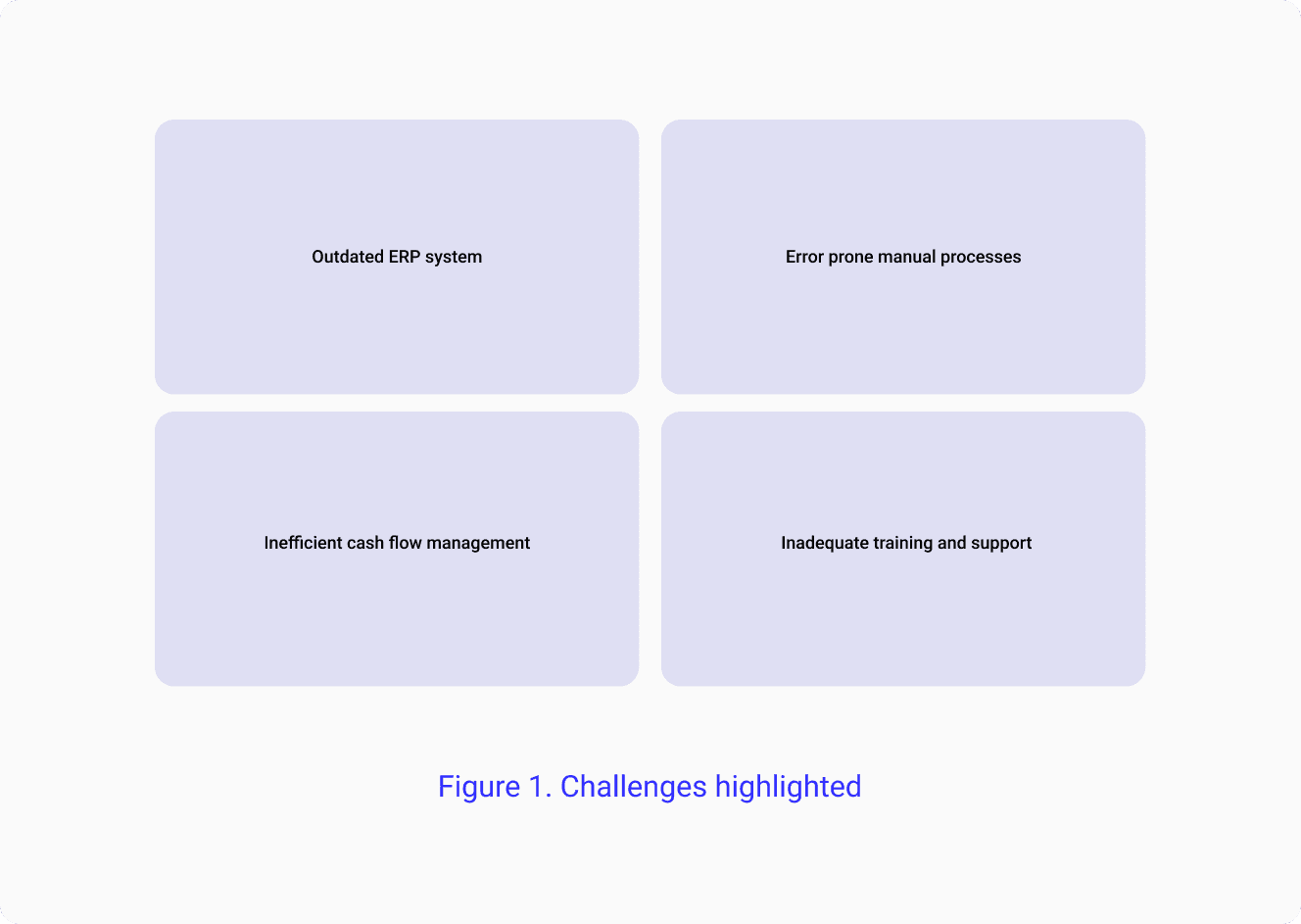

Our client, a leader in advanced radiofrequency measurement and interconnect systems, faced substantial operational challenges after acquiring a new company. The controllership team was understaffed, and reliance on an outdated ERP system (AS400), led to inefficiencies, high error rates, and delayed financial reporting.

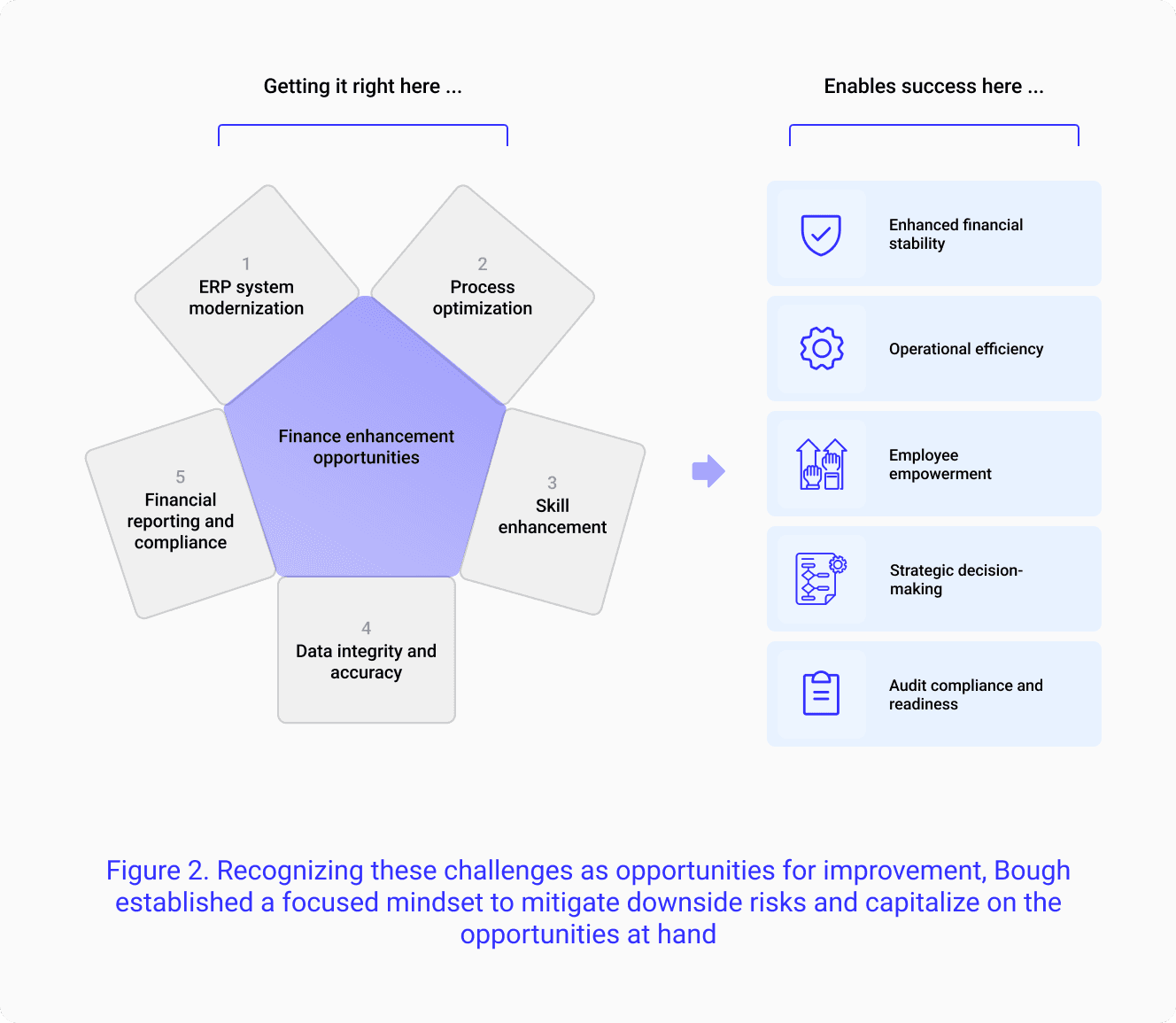

Strategic intervention for sustainable growth

Recognizing the urgent need for change, our client sought a transformative solution that transcended conventional boundaries, encompassing people, processes, and technology. The goal? To streamline financial operations and harness the power of technology for sustained and scalable growth

Innovative financial revamp for lasting efficiency

Bough stepped in as the Interim Controller with a mission to stabilize and optimize the client's financial operations. Our strategy focused on four main pillars: technology integration, process streamlining, skill enhancement, and data accuracy

Technology integration: Modernized the ERP system, conducting a thorough analysis to identify and address its shortcomings

Process streamlining: Automated manual processes and standardized procedures to enhance efficiency and reduce errors

Skill enhancement: Developed tailored training programs to bridge skill gaps and foster continuous professional development

Data accuracy: Implemented data validation protocols and conducted meticulous reviews to ensure financial data integrity

Transformative solutions deployed

Bough implemented a comprehensive array of solutions aimed at enhancing efficiency, accuracy, and transparency. Each solution was carefully designed to address specific pain points identified within the existing financial framework:

Automated cash reconciliation: Introduced a sophisticated system reducing reconciliation time by 80%

Electronic approval workflow: Streamlined cash disbursement processes, enhancing control and transparency

Accelerated AR collections: Leveraged RPA to automate invoicing, improving cash flow and reducing overdue payments

System error resolution: Collaborated with IT to resolve ERP system errors, improving reporting accuracy

Customized dashboards: Developed real-time dashboards for key financial metrics, empowering informed decision-making

Thorough data cleanup: Conducted deep-dive reviews and corrected data discrepancies, ensuring compliance and data integrity

Results

Through Bough's strategic interventions, the client experienced profound improvements across various facets of financial management:

Through Bough's strategic and tech-focused interventions, our client witnessed a profound transformation in its financial operations. These initiatives were carefully designed to address key challenges and leverage technology to drive efficiency, accuracy, and compliance. The results demonstrate significant improvements across various facets of financial management

Enhanced cash flow. Optimized accounts receivable management reduced outstanding balances and improved liquidity

Improved accuracy. Addressed system errors and discrepancies, enhancing financial reporting reliability

Operational efficiency. Automated processes and streamlined workflows led to significant time savings and increased productivity

Audit readiness. Enhanced internal controls and documentation ensured smooth audits and regulatory compliance

Bough's interventions not only stabilized the client's financial operations but also positioned them for scalable and sustainable growth